Popular cryptocurrency trading techniques to be aware of in the UAE

Cryptocurrency is a digital currency that uses cryptography to secure transactions and control the creation of new units (read more here). Cryptocurrencies are decentralised, not subject to government or financial institution control. It makes them an attractive investment for traders seeking independence from centralised systems.

This article will explore some popular cryptocurrency trading techniques and how to avoid scams in UAE. Stay safe out there.

What are the most popular cryptocurrency trading techniques in UAE, and why are they so popular?

The most popular cryptocurrency trading techniques in UAE are day trading, margin trading, and arbitrage. Day trading is buying and selling cryptocurrencies within the same day. It is a high-risk, high-reward strategy that can be profitable if done correctly.

Margin trading is borrowing money from a broker to trade with more money than you have. It amplifies both profits and losses, so it is vital to use stop-loss orders and take profit orders.

Arbitrage is taking advantage of cost differences between exchanges. For example, if the price of Bitcoin is lower on one exchange than another, you can buy on the cheaper exchange and sell on the more expensive exchange. This technique requires knowledge of multiple exchanges and can be challenging to execute.

What are some common scams in cryptocurrency trading, and how can I avoid them?

There are many scams in cryptocurrency trading, so it is vital to be aware of them. One common scam is phishing, where scammers send fake emails or create fake websites that look like legitimate exchanges, and they then use these to steal your login credentials or infect your computer with malware.

Another common scam is Ponzi schemes, where traders promise high returns but use new investors’ money to pay old investors. These schemes eventually collapse, leaving newer investors with nothing. Anonymous groups often run Ponzi schemes, so it can be difficult to tell if a trading group is legitimate.

To avoid these scams, only trade on well-established exchanges with good reputations. Verify the website address and look for HTTPS before entering your login credentials. When joining a trading group, research the group and its members before investing any money.

What are some tips for new cryptocurrency traders in UAE?

If you’re new to cryptocurrency trading, here are some tips to help you get started

- Start small and learn as you go. Don’t risk more than you can afford to lose.

- Don’t FOMO (fear of missing out). Many new traders make the mistake of buying when prices are high and selling when prices are low. It is often a losing strategy.

- Don’t blindly follow advice from others, even if they seem to be successful.

- Have a plan and stick to it. Emotional trading is often unprofitable.

- Use stop-loss orders to limit your losses.

You can become a successful cryptocurrency trader in UAE by following these tips. Just remember to stay safe and always do your research.

How can technical analysis predict price movements of cryptocurrencies in UAE?

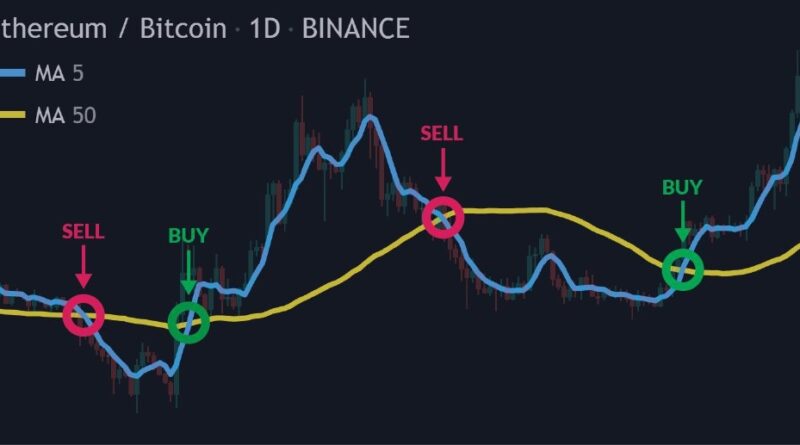

Technical analysis studies past price data to identify patterns and predict future price movements. Many traders use technical analysis when trading cryptocurrencies.

There are many technical indicators, but some popular ones include moving averages, support and resistance levels, and Bollinger Bands.

Moving averages show the average price of a cryptocurrency over a certain period. They can be used to identify trends and make predictions about future prices.

Support and resistance levels are price levels that the market has difficulty breaking through. These levels can be used to set stop-loss orders and take profit orders.

Bollinger Bands are used to measure volatility. When the bands are close together, the market is less volatile. When the bands are far apart, the market is more volatile. Bollinger Bands can predict when a market is about to make a big move.

With technical analysis, traders can make informed decisions about when to buy and sell cryptocurrencies.

Benefits of crypto trading techniques?

Cryptocurrency trading can be a lucrative activity if done correctly. Some of the benefits of cryptocurrency trading include:

Potentially high returns- Cryptocurrencies are known for their potentially high returns. For example, Bitcoin has seen returns of over 9,000{5926015ef26fc784072daf8fb65b1e94b643aff54fd7464f78e9db00bdda6ace} in a single year before.

Access to a new asset class- Cryptocurrencies are a new asset class that is not correlated with traditional assets such as stocks and bonds. This diversification can help to reduce risk in your portfolio.

Anonymity- Cryptocurrencies offer a degree of anonymity that is impossible with traditional assets such as stocks and bonds. It can be appealing to some investors who value privacy.

By understanding the benefits and risks of cryptocurrency trading, you can make informed decisions about whether it is right for you.