Understanding Melt Value And Spot Price Of Gold

When you have some gold to sell, you will come across the terms spot price and melt value. These are terms you need to be familiar with. You need to know what they mean and how they affect you when selling gold. When someone offers you the spot price, then it’s the price of gold at that very moment. But you don’t the first offer that is made when you buy bullion.

For instance, if you wanted to sell an Australian Kangaroo coin or a gold round, you will have to consider the spot price on the day or the very moment you decide to conclude a transaction with a buyer. The spot price is set by the London based gold-exchange and is virtually the same everywhere in the world. However, there are other factors that come into play when a seller puts a price on a gold item. The dealer may add the premium that the original producer of gold (a mint in the case of coins and ingots) institute as a dealer mark-up. You should do your research to understand a buyer’s price.

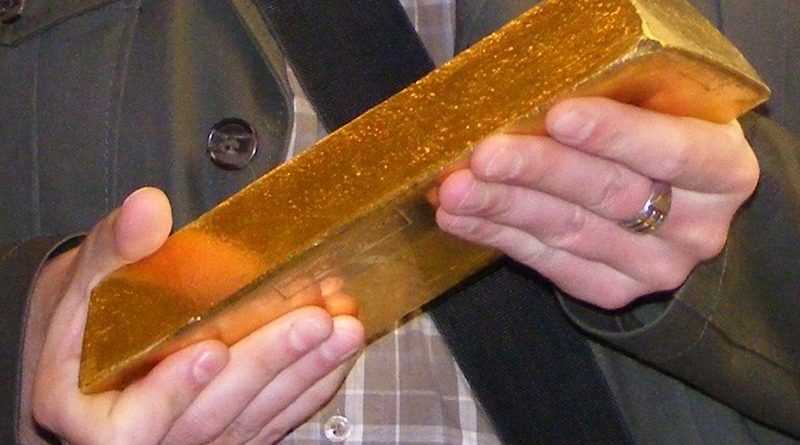

Gold that is minted at one ounce sell at the current spot price plus premium regardless of whether they are a coin or a gold bar.

The melt value refers to the value of gold within the item being sold in relation to other metal alloys in the gold. Simply put, it refers to the value of the gold when it has been extracted and separated from the other metals. The Melt Value is calculated by multiplying the content of gold by the day’s spot price.

Let’s say, for example we have gold item with 0.85 ounce gold and the spot price of gold is $1,250/oz then the melt value will be calculated like this: The standard mass of the gold item (0.85 oz) x gold spot price ($1,250/oz). i.e 0.85 x 1,250 = $1062. 5 This is the melt value of gold item. Note that an ounce of gold will be equal to the spot price. 1 Oz. Gold is equal to $1,250. The melt price rises along with the weight of gold.

You might wonder why you need to worry about the melt price. The question you could be asking, especially if you only have an ounce of gold, is: why should you differentiate spot and melt prices. After all, the value should be the same, right? Theoretically, that is true but there are some factors that add to the costing of gold bullion.

Gold buyers take into account the condition of the coin. Gold bullion coins will show signs of degradation with time. Old coins will have signs of wear if they have been used over the year. A gold dealer who buys gold pieces in any condition is only doing so to melt them down. Bulk purchases are more sensible as they will ensure that the buyer will have a sizeable weight to take to a refinery. Things like rare coins for instance aren’t handled the same way as old jewellery and scrap. Melting gold is a long and complicated process, refineries costs are passed on to customers which means they are factored into the final sale price.

Refinery premiums for gold bullion and gold jewellery are low, however they are more for rare and collectible coins. This is because of the narrative that comes with a collectable coin. Gold buyers purchase bullion coins directly for their melt value, collectors who buy bullion for their investment value will be interested in the narrative and the provenance of whatever coins they buy.